Documents for GST Registration

Who Should Register for GST? Individuals registered under the Pre-GST law (i.e., Excise, VAT, Service Tax, etc.) Businesses with turnover above the threshold limit of Rs. 40 Lakhs* (Rs. 10 Lakhs for North-Eastern States, J&K, Himachal Pradesh, and Uttarakhand) Casual taxable person / Non-Resident taxable person Agents of a supplier & Input service distributor Those

- Published in Goods and Service tax- GST

Is a GSTIN Mandatory for Importer and Exporter

According to the latest circular issued by the government, IEC is not mandatory for all traders who are registered under GST. In all such cases, the PAN of the trader shall be construed as a new IEC code for the purpose of import and export. Import Export Code (IEC) isn’t required to be taken in

- Published in Goods and Service tax- GST

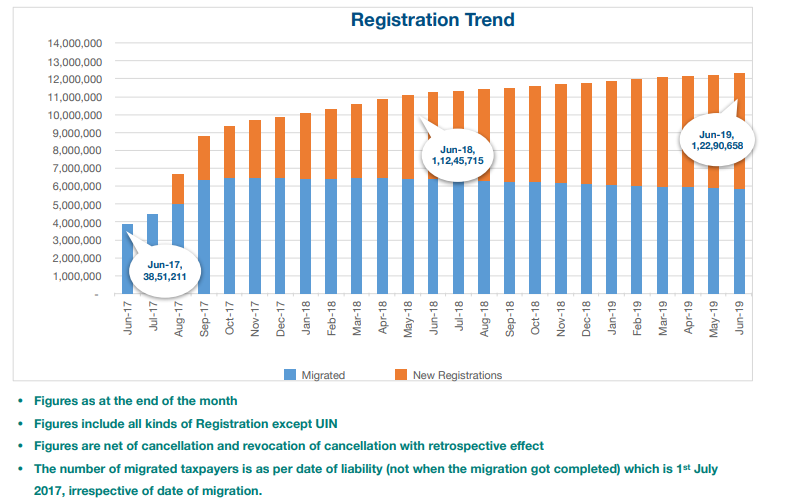

GST Registration Trend and Analysis

GST Registration Trend (Aug – 17 till June – 19) IN INDIA The number of registered taxpayers at the time when the GST was rolled out was Rs 65 lakh, which today stands at Rs 1.2 crore, a jump of 84% over the last two years. This shows a significant widening of the tax base

- Published in Goods and Service tax- GST

GST Updated News

GST Council in the 31st meeting held on 22nd December, 2018 at New Delhi took following decisions relating to changes in GST rates, and clarification (on Goods). The decisions of the GST Council have been presented in this note for easy understanding. The same would be given effect to through Gazette notifications/ circulars which shall

- Published in Goods and Service tax- GST

All About GSTR 9 -ANNUAL RETURN FILING

1. What is GSTR 9? GSTR-9 is an Annual Return to be filed by the persons registered under the GST including those registered under composition scheme. It consists of details regarding the supplies made and received during the year under different tax heads i.e. CGST, SGST and IGST. It consolidates the information furnished in the

- Published in Goods and Service tax- GST