Documents for GST Registration

Who Should Register for GST? Individuals registered under the Pre-GST law (i.e., Excise, VAT, Service Tax, etc.) Businesses with turnover above the threshold limit of Rs. 40 Lakhs* (Rs. 10 Lakhs for North-Eastern States, J&K, Himachal Pradesh, and Uttarakhand) Casual taxable person / Non-Resident taxable person Agents of a supplier & Input service distributor Those

- Published in Goods and Service tax- GST

One Time Relaxation to Employers, Taxpayers, and Business Entities

The outbreak of the Novel Corona Virus (#COVID-19) across many countries of the world including India has caused immense economic and business loss. Amid this difficult situation, the Government has announced below one time relaxations for Employers, Taxpayers and Business Entities. One Time Relaxation for Tax Payers and Business Entities Income-tax Refunds: It has been decided to issue

- Published in ESI, Goods and Service tax- GST, INCOME TAX

GST on Remuneration Paid to Directors?

Taxability on Remuneration Paid to Directors Under GST Recently in the matter of Clay Crafts India Private Limited [TS–218–AAR–2020–NT], the Rajasthan Authority for Advance Ruling (“AAR”) stated that consideration paid to directors is against the supply of services provided by them to the company and are not covered under clause (1) of the Schedule III

- Published in Goods and Service tax- GST

Is a GSTIN Mandatory for Importer and Exporter

According to the latest circular issued by the government, IEC is not mandatory for all traders who are registered under GST. In all such cases, the PAN of the trader shall be construed as a new IEC code for the purpose of import and export. Import Export Code (IEC) isn’t required to be taken in

- Published in Goods and Service tax- GST

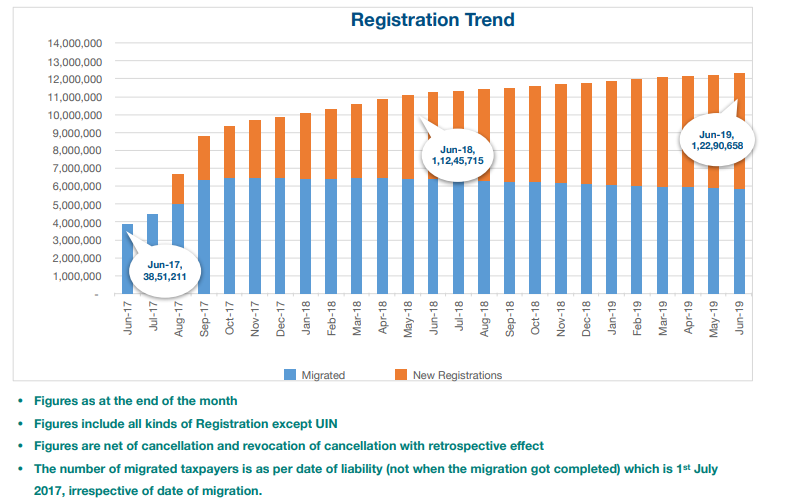

GST Registration Trend and Analysis

GST Registration Trend (Aug – 17 till June – 19) IN INDIA The number of registered taxpayers at the time when the GST was rolled out was Rs 65 lakh, which today stands at Rs 1.2 crore, a jump of 84% over the last two years. This shows a significant widening of the tax base

- Published in Goods and Service tax- GST

GST Updated News

GST Council in the 31st meeting held on 22nd December, 2018 at New Delhi took following decisions relating to changes in GST rates, and clarification (on Goods). The decisions of the GST Council have been presented in this note for easy understanding. The same would be given effect to through Gazette notifications/ circulars which shall

- Published in Goods and Service tax- GST

All About GSTR 9 -ANNUAL RETURN FILING

1. What is GSTR 9? GSTR-9 is an Annual Return to be filed by the persons registered under the GST including those registered under composition scheme. It consists of details regarding the supplies made and received during the year under different tax heads i.e. CGST, SGST and IGST. It consolidates the information furnished in the

- Published in Goods and Service tax- GST

What to do if your last GSTR-3B has errors?

Made an error in GSTR-3B Yesterday was the last date to file your GSTR-3B for September 2018. This was also the last opportunity to claim any leftover ITC, or report sales missed earlier or make sure those who sell to you have reported it properly. In case you’ve committed a mistake in filing this GSTR-3B,

- Published in Goods and Service tax- GST

Impact of TCS on sellers- Purpose of Introduction of TDS on GST

TDS must be deducted where total value of supply exceeds Rs 2.5L. This only applies where the payer is a government entity (central and state govts, local authority, govt agency) or those notified by the govt as GST Council may suggest from time to time. Is TDS on GST 1% or 2%? 1% TDS is required

- Published in Goods and Service tax- GST

Advisory for Taxpayers to file Refund for Multiple Tax period – under GST

Refund application filing for multiple tax period is available for below grounds of refund: Export of Goods & Services-Without payment of Tax Export of services with payment of tax Supplies made to SEZ Unit/SEZ Developer-Without payment of Tax Supplies made to SEZ Unit/SEZ Developer-With payment of Tax ITC accumulated due to an inverted tax structure

- Published in Goods and Service tax- GST