Managing current/short-term funds is critical for the long-term success of any Startup. Working Capital Management or in simple words ensuring adequate short-term liquidity is important in order to meet current business obligations, and in the process ensuring the survival of the business.

Very often start-ups forget that your financing is great but one element they forget is working capital and I think we forgot that once and that was the only time we made that mistake where we calculated the amount of capital we needed, we raised exactly that amount of capital and we actually weren’t burning any money at all. We were profitable and we still found ourselves in that situation where we said there is no money in the bank and we said why there is no money in the bank and then we said hang on our working capital cycle is off. We are paying in 30 days and receiving in 60 and that’s how we don’t have any money in the bank. It was a big shock to us and it seems trivial and small looking back because now we have improved at managing it but I have met many start-ups along the way who simply forget the factor how much money they need to keep the lights on and I think that’s the crucial, that was our second big learning. Every time we raise capital factor, working capital and more working capital than you think you need and then sort of spend capital accordingly. Said Sahil Barua, Founder of Delhivery.

Working capital is something that is very essential for entrepreneur to make sure that they can cover their daily expenditure.

-Preetesh Anand

Founder SPLAN

In a manufacturing concern, there is a time lag between the times raw material is procured until the time money is realized on sale of finished products to the customers. Working Capital provides the funds during this time lag.

Working Capital has two major components. They are:

- Permanent Working Capital – that which remains stable over a period of time, and is predictable to some extent. This has to be estimated basis the plans of the business.

- Fluctuating Working Capital – that which allows fluctuations over the period depending upon the needs and requirements of the business, and allows the business to take advantages of sudden opportunities that might come its way.

There are many factors that influence the working capital needs of an organization. Some of these factors are:

- Nature of Business

- Size of Business

- Production Cycle

- Type of Industry

- Business Fluctuations

- Access to Banking Facilities

- Profit and Taxes

Importance of Operating Cycle

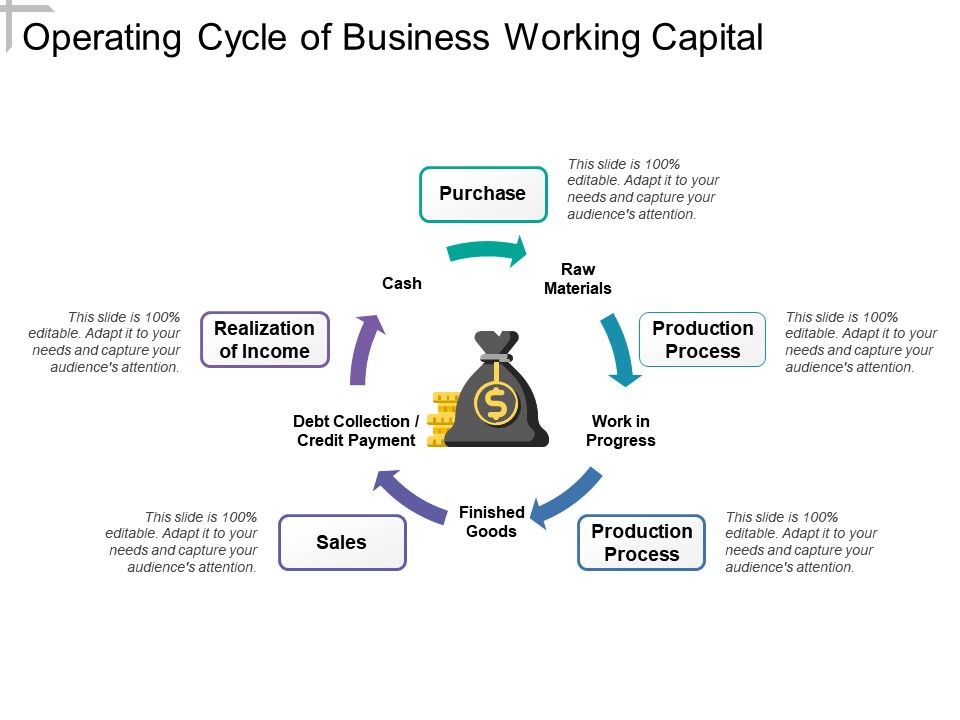

The understanding of working capital becomes easy when you look into a company’s operating cycle. The cycle starts with the purchase of raw materials by paying cash. Then, the raw materials are converted into work-in-progress (WIP) and then to finished goods through value addition.

How to Determine the Working Capital Needs?

The working capital of an enterprise can be calculated by applying a simple formula: working capital = current assets – current liabilities. Current assets include short-term assets that can be converted into cash within a year, whereas current liabilities refer to the short-term liabilities which are due payment within a year. An enterprise’s working capital can be either positive or negative. But the working capital needs differ from one enterprise to another. The working capital requirements even differ from one industry to another. There are a number of factors that influence the working capital needs of a business directly.

By now you must have realized the importance of working capital and how critical it is to ensure the smooth operating of a business. We should dive deeper now to understand how to estimate the working capital required for your business for which understanding the concept of an operating cycle is

going to be very important.

Financing and Management of Working Capital

Once the short-term fund requirement of the business has been estimated, the organisation needs to organise these funds. There are several routes by way of which this can be done. It can be financed by the venture’s short term liabilities/obligations or in some cases; this can even be financed through long-term sources like Debt or Equity.

It is necessary that these short-term funds are utilised in the most efficient manner, and if not done well, this often becomes the root cause for the downfall of startups with good potential. Following are the tips that will help you efficiently manage your working capital needs:

- Maintain current assets that liquidate into cash quickly, when needed

- Increase efficiency of the operating cycle, by reducing the time it takes from “Raw Material” to “Cash.”

- Manage your receivables/payables better, by limiting the credit period you offer to clients, and trying to enhance the credit period you take from suppliers

- Manage your inventory, by liquidating more than you store It’s

For More Classes of Startup Master Class Click hear