GST Registration Trend and Analysis

Wednesday, 24 July 2019

by Anand splan

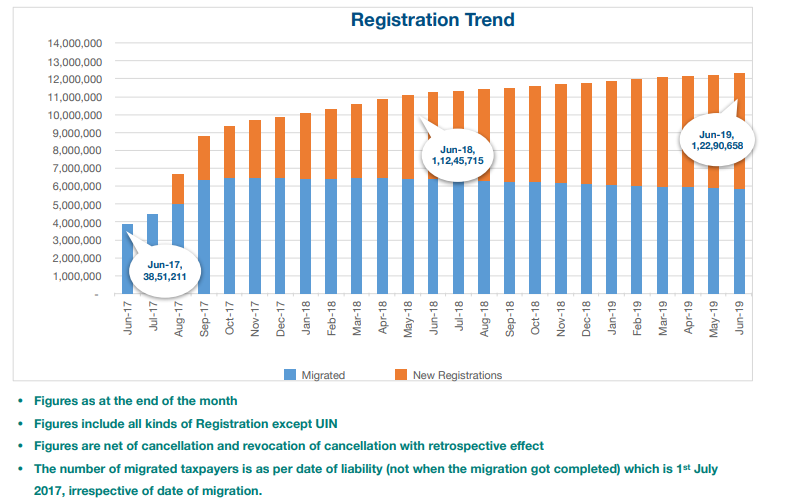

GST Registration Trend (Aug – 17 till June – 19) IN INDIA The number of registered taxpayers at the time when the GST was rolled out was Rs 65 lakh, which today stands at Rs 1.2 crore, a jump of 84% over the last two years. This shows a significant widening of the tax base

- Published in Goods and Service tax- GST

Impact of TCS on sellers- Purpose of Introduction of TDS on GST

Tuesday, 23 October 2018

by Anand splan

TDS must be deducted where total value of supply exceeds Rs 2.5L. This only applies where the payer is a government entity (central and state govts, local authority, govt agency) or those notified by the govt as GST Council may suggest from time to time. Is TDS on GST 1% or 2%? 1% TDS is required

- Published in Goods and Service tax- GST