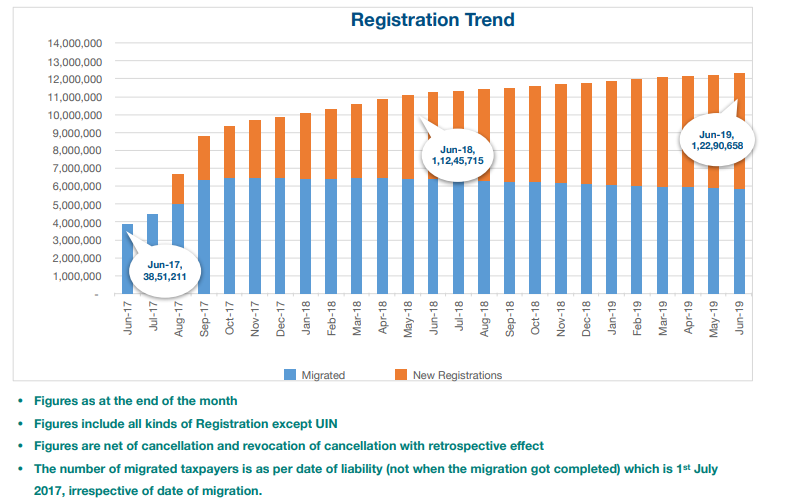

GST Registration Trend and Analysis

GST Registration Trend (Aug – 17 till June – 19) IN INDIA The number of registered taxpayers at the time when the GST was rolled out was Rs 65 lakh, which today stands at Rs 1.2 crore, a jump of 84% over the last two years. This shows a significant widening of the tax base

- Published in Goods and Service tax- GST

All About GSTR 9 -ANNUAL RETURN FILING

1. What is GSTR 9? GSTR-9 is an Annual Return to be filed by the persons registered under the GST including those registered under composition scheme. It consists of details regarding the supplies made and received during the year under different tax heads i.e. CGST, SGST and IGST. It consolidates the information furnished in the

- Published in Goods and Service tax- GST

What to do if your last GSTR-3B has errors?

Made an error in GSTR-3B Yesterday was the last date to file your GSTR-3B for September 2018. This was also the last opportunity to claim any leftover ITC, or report sales missed earlier or make sure those who sell to you have reported it properly. In case you’ve committed a mistake in filing this GSTR-3B,

- Published in Goods and Service tax- GST