Startup India is a flagship initiative of the Government of India, intended to catalyse startup culture and build a strong and inclusive ecosystem for innovation and entrepreneurship. The main goal of Startup India is to ensure that each startup transforms into a viable business and is able to scale its growth. Keeping this in mind, Startup India recognises startups in order to give them exclusive benefits.

How to Apply for Startup India

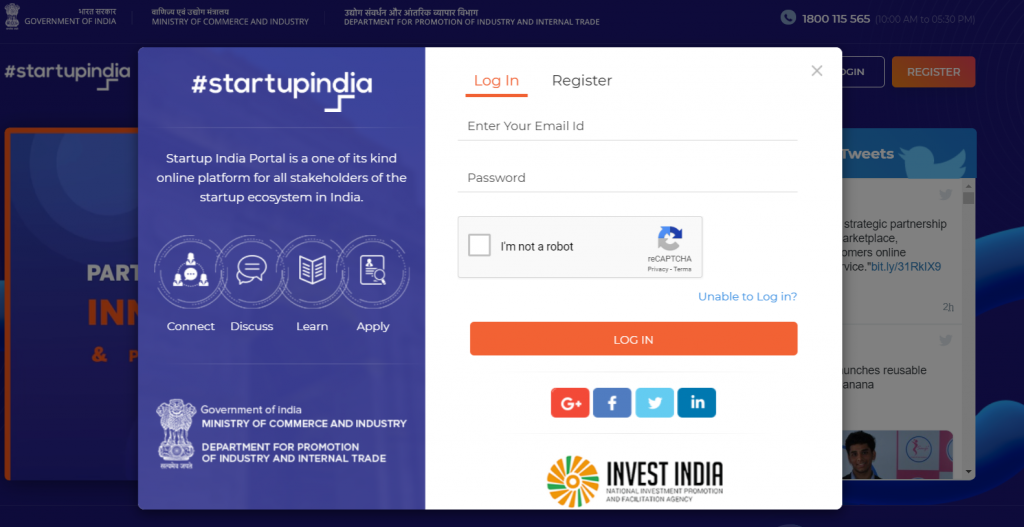

- Log in to www.startupindia.gov.in, if you are not registered then register first.

- Click on Application for recognization of Startup

- Fill out an application form and upload your company profile.

- After 2 to 3 days

A recognized Startup can avail various benefits including:

- Section 80-IAC of Income Tax benefit: Income Tax exemption for 3 years post-approval from IMB

- Section 56 of Income Tax exemption benefit: Tax exemption on Investment above Fair Market Value

- Intellectual Property Rights (IPR) Benefits: :

- Fast-tracking of Startup patent applications

- Panel of facilitators to assist in filing of IP applications

- Startups are provided an 80% rebate in filing of patents and 50% rebate in filing of Trademarks vis-à-vis other companies

- Relaxation in public procurements norms: Subject to certain conditions, Startups are entitled to avail exemption with following condition:

- Prior Turnover and Experience

- Earnest Money Deposit

- Self-Certification for compliance under certain Labour & Environment laws for a period of 5 years from the date of incorporation

- Access to Fund of funds for startups: To provide equity funding support for development and growth of innovation-driven enterprises, the government has set aside a corpus fund of 10,000 crores managed by SIDBI

- Faster exit for startups: MCA has notified Startups as ‘fast track firms’ enabling them to wind up operations within 90 days vis-a-vis 180 days for other companies

- Recognised startups may raise External Commercial Borrowings up to USD 3 Mn

- Easier compliances for recognized startups: Requirement to hold 2 board meetings in a financial year in place of 4; allowance to get annual return signed by the director, in case there is no company secretary and many more

These benefits and resources are available to #StartupIndia recognised Private Limited companies, LLPs and Registered Partnership firms.