An employee, who is entitled to relief under Section 89 of the Income Tax Act, is required to submit Form 10E. Here’s how it can be filed.

When an employee receives advance or arrears from his employer, then there is an increase in taxes in the year of receipt. To mitigate such hardship, tax relief (relief under Section 89) is provided. If certain conditions are met, then this relief shall reduce the taxes of individual.

Section 89 relief can be claimed if during the year the employee receives any of the following:

- Salary received in arrears or in advance

- Premature withdrawal from Provident Fund

- Arrears of family pension

- Gratuity

- Commuted value of pension

- Compensation on termination of employment

An employee, who is entitled to relief under Section 89, is required to submit Form 10E. It has to be filed online at the e-filing portal and has to be filed before filing of the Income Tax Return. If you have filed up Form 10E after filing of ITR, then the Income Tax Department might not allow the Section 89 relief claimed in ITR.

Here, we have explained step-by-step process to e-file the Form 10E.

Step 1: Go to www.incometaxindiaefiling.gov.in and login with your PAN and Password.

Step 2: Go to E-File > Income Tax Forms from the menu

Step 3: Select Form 10E- Form for Relief u/s 89 from the drop-down box of Form Name. Also, choose the relevant Assessment Year and Submission mode to continue further.

Select Form 10E- Form

Step 4: On the next page, the first tab provides the General Instructions about filling of Form 10E.

Step 5: In Tab 2, the basic details like Name, Address, PAN, etc. will be pre-filled. Select the Residential Status from the drop-down box.

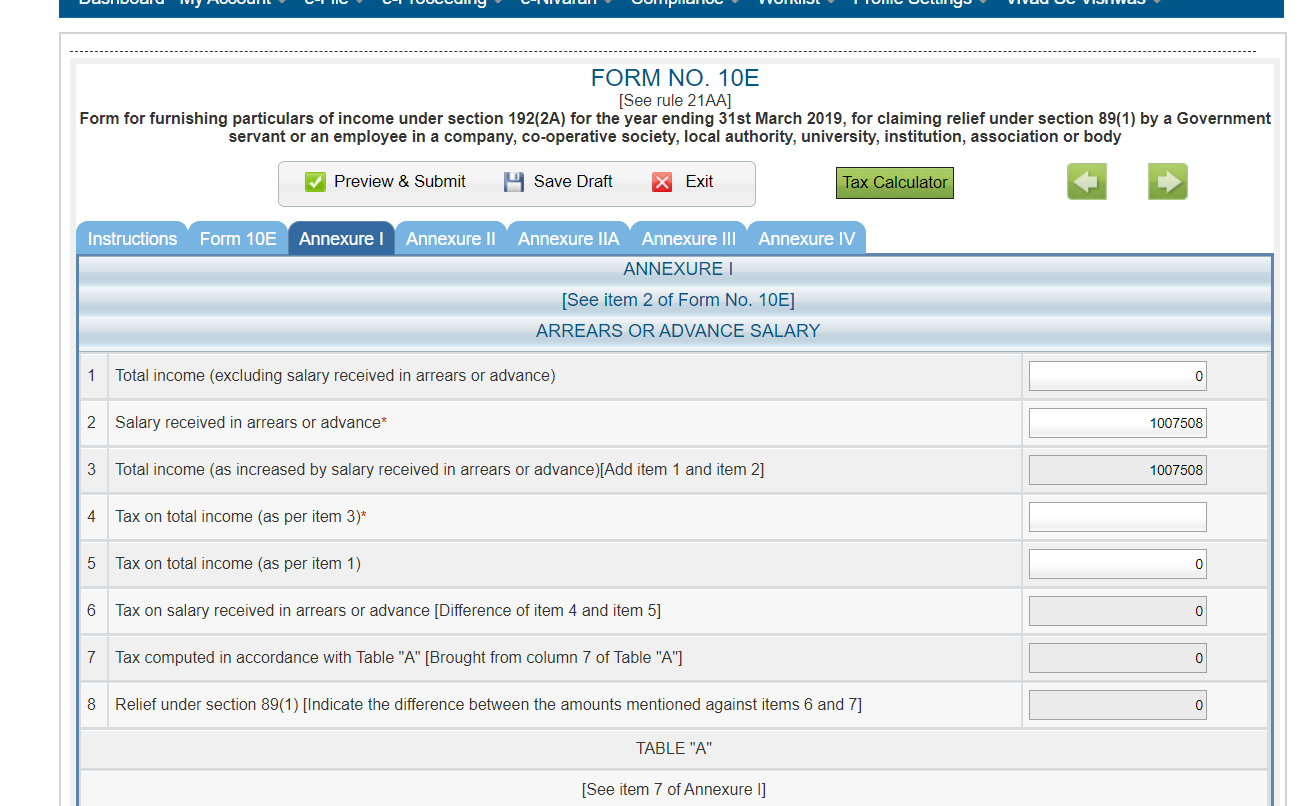

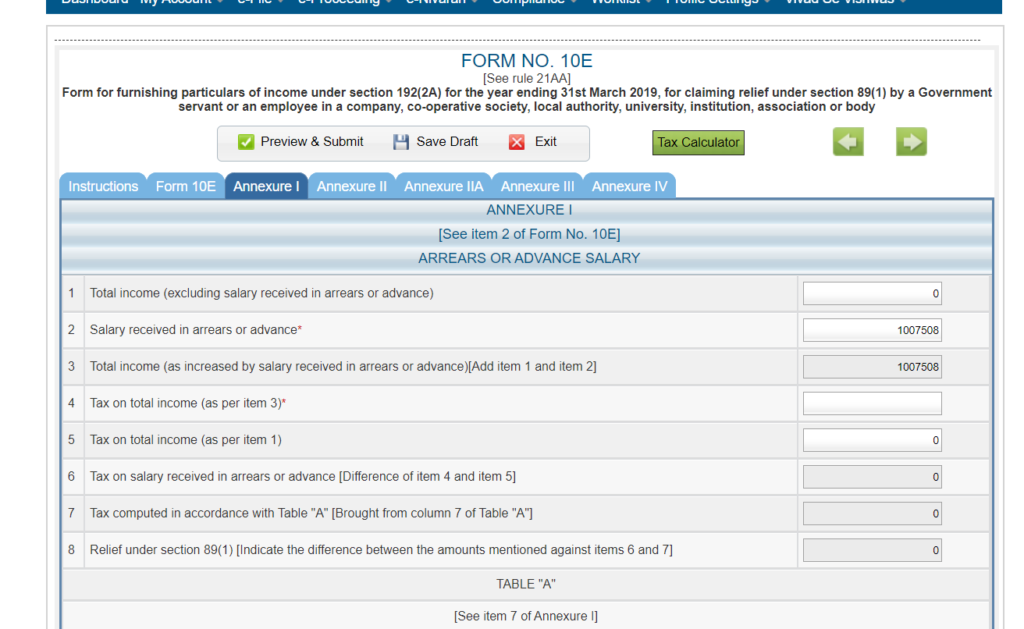

Step 6: Choose the relevant Annexure to be filled:

- Annexure I: This Annexure has to be filled if the employee wants to claim relief in respect of Salary received in arrears or advance or family pension received in arrears or premature withdrawal from Provident Fund.

- Annexure II: This Annexure is to claim relief in respect of Gratuity received for services rendered for 5 years or more, but less than 15 years.

- Annexure IIA: This Annexure is to claim relief in respect of Gratuity received for services rendered for 15 years or more.

- Annexure III: When relief has be claimed in respect of Compensation received on Termination of Employment, the Annexure III shall be filled up.

- Annexure IV: This has to be filled up when relief is claimed in respect of Commutation of Pension.

Step 7: Verify the Form and then Select Preview & Submit:

Step 8: You can download the PDF copy for preview. If you find any error or omission in the form, you can click on ‘Edit’ to make corrections in the form. If details entered are correct, one can proceed for final submission of Form.