Income tax return filing due date has been extended to August 31 for FY2018-19

There are a few things we need to know if we are eligible for filing the income tax return. Indian govt. makes changes in the budget from time to time and we need to get updated with that. Hence, in gist, we are trying to explain a simple way of filing the income tax return. For all, the authentic site for filing a tax return is https://www.incometaxindiaefiling.gov.in/home. And before filing your income tax return it is important to go through this https://www.incometaxindiaefiling.gov.in/main/ListOfITRsAndOtherForms. Here you get acquainted with all the forms that are to be filed by individuals, HUF, firms, companies, trust, etc. as per their requirement.

From this year the income tax department made changes in their website and it becomes so easy for an individual to file an income tax.

Income Tax computation slab for AY 2019-20

Upto 60 years of age

| INCOME | TAX LIABILITY | |

| 1 | Upto Rs. 2,50,000/- | Nil |

| 2 | Rs. 2,50,001/- – to Rs. 5,00,000/- | 5% of income in excess of Rs, 2,50,000/- |

| 3 | Rs. 5,00,001/- to Rs. 10,00,000/- | Rs. 12500/- + 20% of income in excess of Rs. 5,00,000/- |

| 4 | Above Rs. 10,00,000/- | Rs. 1,12,500/- + 30% of income in excess of Rs. 10,00,000/- |

For 60 to 80 years of age – Senior Citizen Ay 2019-2020

| INCOME | TAX LIABILITY | |

| 1 | Upto Rs. 3,00,000/- | Nil |

| 2 | Rs. 3,00,001/- – to Rs. 5,00,000/- | 5% of income in excess of Rs, 3,00,000/- |

| 3 | Rs. 5,00,001/- to Rs. 10,00,000/- | Rs. 10000/- + 20% of income in excess of Rs. 5,00,000/- |

| 4 | Above Rs. 10,00,000/- | Rs. 1,10,000/- + 30% of income in excess of Rs. 10,00,000/- |

For above 80 years of age Super Senior Citizen, AY 2019-20

| INCOME | TAX LIABILITY | |

| 1 | Upto Rs. 5,00,000/- | Nil |

| 2 | Rs.5,00,001/- to Rs.10,00,000/- | 20% of income in excess of Rs, 5,00,000/- |

| 3 | Above Rs. 10,00,00/- | Rs. 1,00,000/- + 30% of income in excess of Rs. 10,00,000/- |

If you are an individual and having income from salary, one house property and other sources (like interest from FD. Etc) and total income is up to 50 lakhs, you need to file ITR 1.

The path that you should follow will be like:

- Go to this site https://www.incometaxindiaefiling.gov.in/

- Click on LOGIN HERE (If you are already registered, else registered as new with your PAN no)

- Enter your User ID (with PAN no) and Password, Enter Captcha code and click on log in.

- Click on My account tab and view you Form 26AS (It is a consolidated tax statement which has all tax-related information associated with your PAN. It shows how much your tax has been deducted from multiple sources like salary, pension, interest income)

- You will be redirected to TDS CPC site to view your Form 26AS, Click on CONFIRM. Once you click on confirm one pop will come. Click on the checkbox and then click on PROCEED. Click on VIEW TAX CREDIT (FORM 26 AS). Select the assessment year and how you want to view your data like HTML or text. If you are a salaried person and your employer deduct some tax from your salary, then it shows under Sec 192 and if case some other company deducted some tax out of the interest income then it comes under Sec 194A. There can be some other sources from where tax has been deducted. Here you should verify the amount that has been credited as income/interest income and the amount of tax that has been deducted from that income.

- Once you verify your Form 26AS come back to income tax e-filing site and click on FILING OF INCOME TAX RETURN.

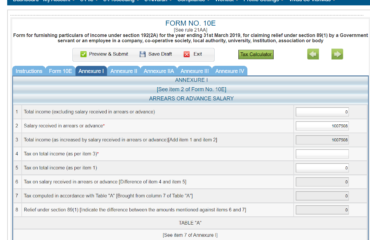

- Few pop-ups will come, you must tick the checkbox and proceed further. Then they ask you to fill your personal details like Name, contact no., E-Mail id, Address, etc. few things are not mandatory so you can skip that. And you have to give the mobile OTP and E-mail OTP. Once you give the OTP your actual return filing starts. There are 7 tabs like Instructions, PART A General information, Computation of Income and Tax, Tax details, Tax paid and verification, Donation 80G, Donation 80GGA. As you have only 15 min time to file, it is a good practice to save your draft from time to time. Once you save it, the countdown starts again.

- In Part A General Information first few points are auto-filled; you can also make changes in that also. You select Nature of employment from the drop-down as per your criteria.

- In the computation of Income and Tax tab has two parts B and C. Part B has the income portion and Part C has the deduction portion. Few fields are auto-filled and are exactly same as per your Form 16A given by your employer. Most of the fields are self-explanatory only you need to verify the amount in all the fields Deductions, Professional tax. If you claiming the HRA deduction you need to fill the amount in 80GG and also fill the Form 10BA (a declaration that you have given agreed amount to your owner). And If your employer has mentioned in your Form 16A in Sec 10 you need to select that section from the drop-down of exempt allowance menu. Interest from the deposit, interest from saving, family pension and interest from the income tax refund of last year also comes under your income. So, the tax must be deducted from that interest. And after that other fields are auto-calculated.

- In Tax detail tab the fields are auto-calculated as per the amount you have filled in the previous tab.

- If case your employer has not deducted the required tax from your salary or you gave a mandate like Form 15G/ 15H in the bank then you need to pay calculated tax at the time filing. Also, in case extra tax has been deducted you will get a refund.(Keep this in mind that refund you get this year and the interest on that will become the interest income in the next year).

- There are also some other parts like Part E, where you need to give all the bank account details.

- Also, if you gave any donation then filled that amount in that particular field.

- Lastly, you need to do the e-verification through an Aadhar OTP, through net banking or EVC.